SoFi Technologies, Inc. (NASDAQ:SOFI) is trading higher Tuesday despite there being no company-specific news. It appears to be forming a new trading range.

We have made it our Stock of the Day. There are typically two ways to trade a range profitably. One is to buy near the bottom of the range and sell close to the top. The other is to wait for the stock to break out of the range.

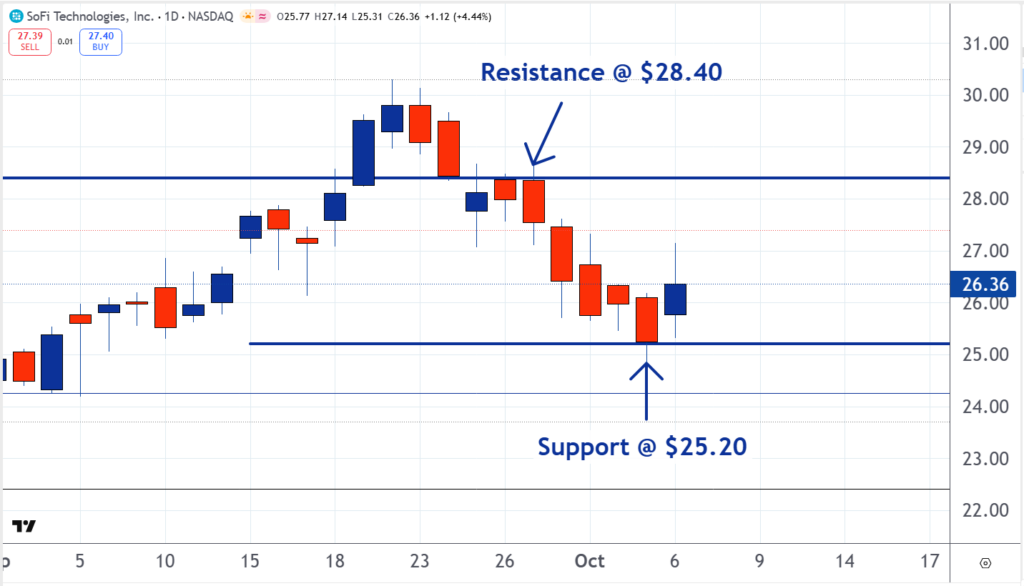

As you can see on the chart below, there was recently resistance for SoFi around $28.40. There is a good chance that if the stock reaches this price, it will reencounter resistance, marking the top of a new trading range.

There can be resistance at prices that were previously resistance levels. This is a common occurrence in markets.

Some people who acquire shares when the price is at resistance regret doing so when the price drops. Some make the decision to hold onto their losing positions, but they also decide to sell if they can eventually get out at breakeven.

Read Also: AMD’s OpenAI Deal Could Spark A New AI Arms Race With Nvidia

This means if SoFi returns to $28.40, there will be remorseful buyers placing sell orders. This could create resistance at the level again.

The recent support for the stock was at the $25.20 level. This could become the bottom of the new range.

Some of the people who sold there now regret doing so because the price is higher. Some investors vowed to buy back their shares if they could purchase them at the same price they sold for.

This buying could create support at the level again.

Some traders will consider buying SoFi if it drops back to this support. They would plan to sell if it approached the resistance.

Other traders will buy shares if the resistance is broken and they trade above it. This could mean that the sellers who created the resistance have left the market. With this supply out of the way, the stage could be set for a move higher,

Read Next:

- Trump Ignites Metal Stock Frenzy--These Names Could Be Next

Image: Shutterstock