📉The stock market declined last week, with the S&P 500 shedding 1.4% to end at 5,728.80. The index is now up 20.1% year to date and up 60.2% from its October 12, 2022 closing low of 3,577.03. For more on the stock market moves, read: Keep your stock market seat belts fastened 🎢

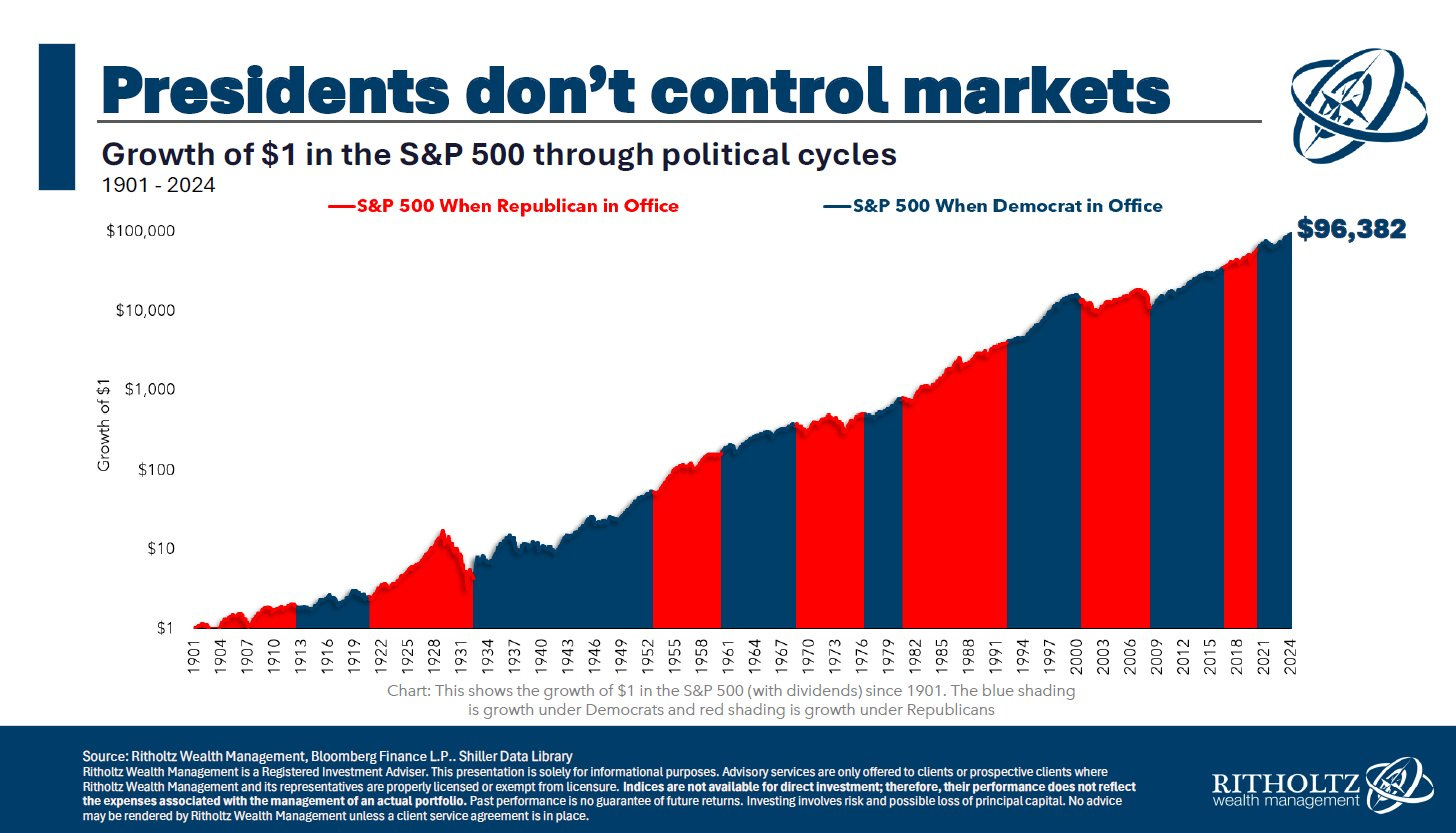

History shows that the stock market usually performed well regardless of the U.S. president’s political party.

This suggests that there isn’t a political party that’s necessarily bad for the stock market. Maybe some presidents are better for the market than others, especially at the industry level. But there isn’t clear evidence showing that a particular president alone can have enough of a material, long-term impact that the fundamentals driving the market higher will turn unfavorably.

“Over time, the stock market’s strongest threads have been the economy and earnings, not who’s in the Oval Office,” Ritholtz Wealth Management’s Callie Cox said.

The stock market has a history of going up, regardless of the political party occupying the Oval Office. (Source: @CallieCox)

At the margin, however, the results of a presidential election can certainly cause market volatility to rise in the short-term. After all, each candidate comes with very different ideas for policies like the corporate tax rate. Over time, companies will adapt and adjust to new policies as they work to preserve earnings growth. But they need some clarity as to what those new policies could be before proceeding with changes.

As such, companies will often take a wait-and-see approach ahead of an uncertain election. That’s a headwind for economic activity in the short-term. And with polling data showing the presidential candidates neck and neck ahead of this year’s election, companies are once again saying that they’ll wait for election results to move forward with any changed business strategies.

“It was unsurprising that the U.S. election came up quite a bit in last week’s earnings calls,” RBC’s Lori Calvasina said on Monday. “As has been the case in recent quarters, there were numerous references to the uncertainty that the event has created and the adverse impact that uncertainty has had on business activity. Several companies noted the need to simply get to the other side.”

Upgrade to paid

Declining Uncertainty Could Be Bullish Regardless Of The Election Outcome

Uncertainty doesn’t only keep business executives on the sidelines. It keeps traders and investors on the sidelines too.

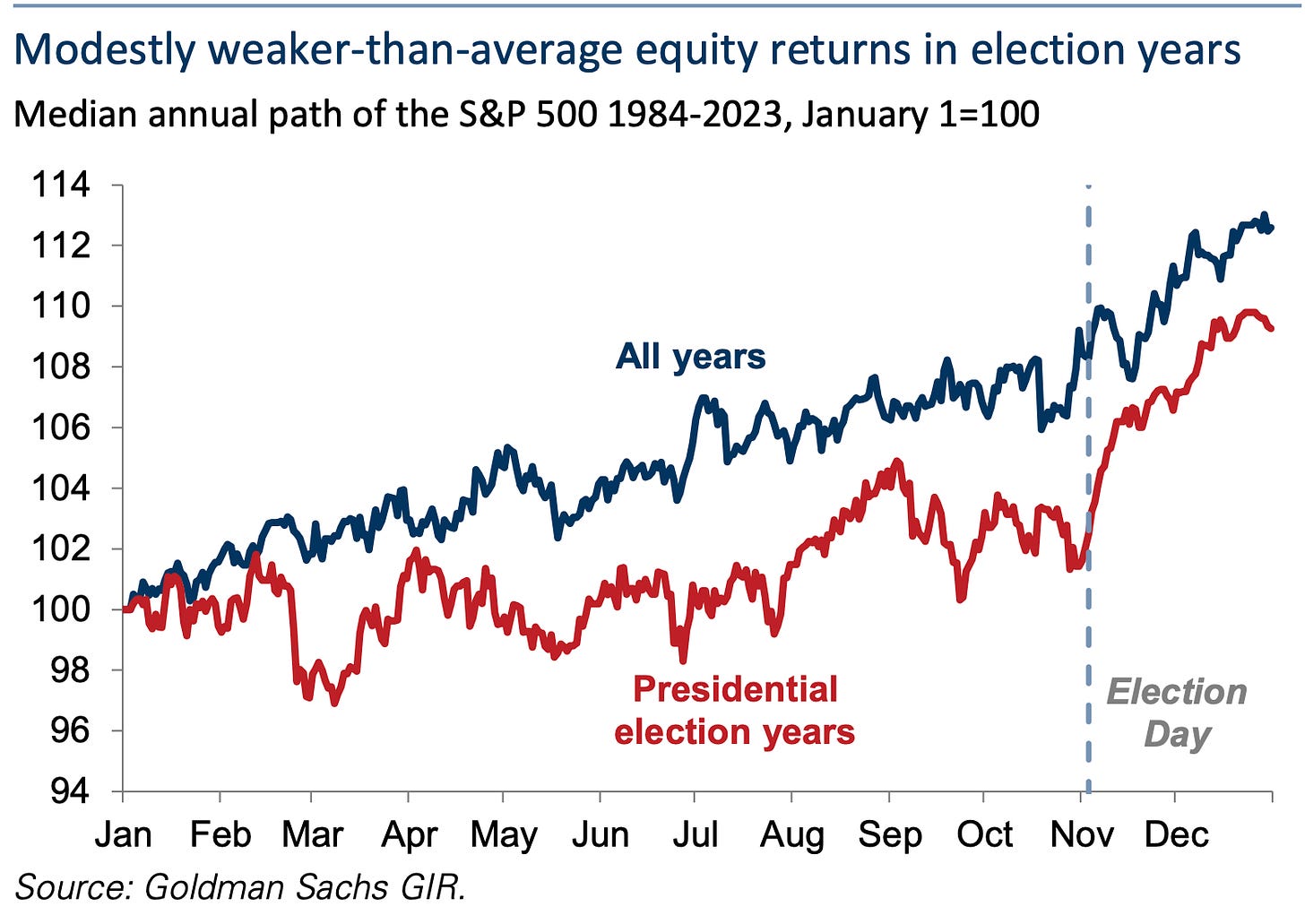

History shows that during election years, the stock market tends to deliver below-average returns ahead of Election Day. However, the rally tends to pick up once we “get to the other side” and the uncertainty wanes.

“[R]egardless of the election outcome, declining uncertainty typically lifts equity valuations and prices following Election Day by more than the typical seasonality would suggest,” Goldman Sachs’ Ben Snider wrote in a February note to clients.

Stocks have historically performed weaker-than-average during election years ahead of Election Day, but strength generally returns after Election Day. (Source: Goldman Sachs via TKer)

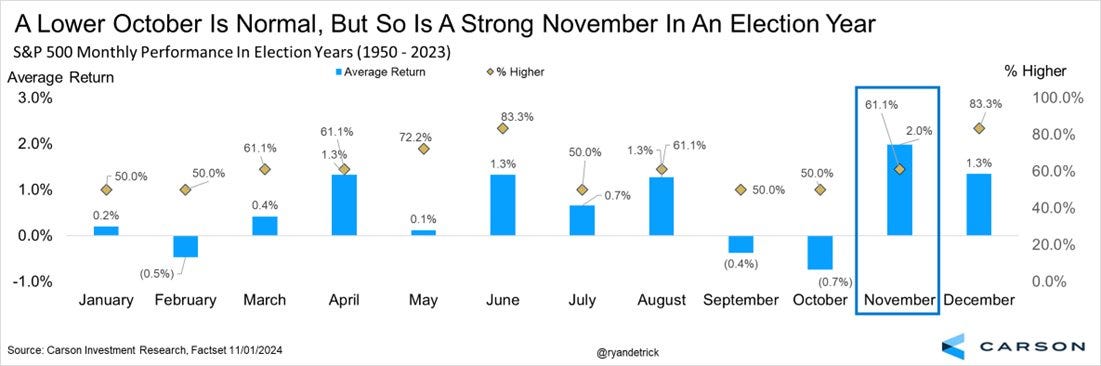

The fact that the S&P 500 fell 1% in October is very much consistent with history.

“October is the worst month of the year in an election year,” Carson Group’s Ryan Detrick said. “So maybe down some last month shouldn't be a huge surprise?”

(Source: @RyanDetrick)

“What also shouldn't be a surprise is strength in November, as this is the best month of an election year,” Detrick added.

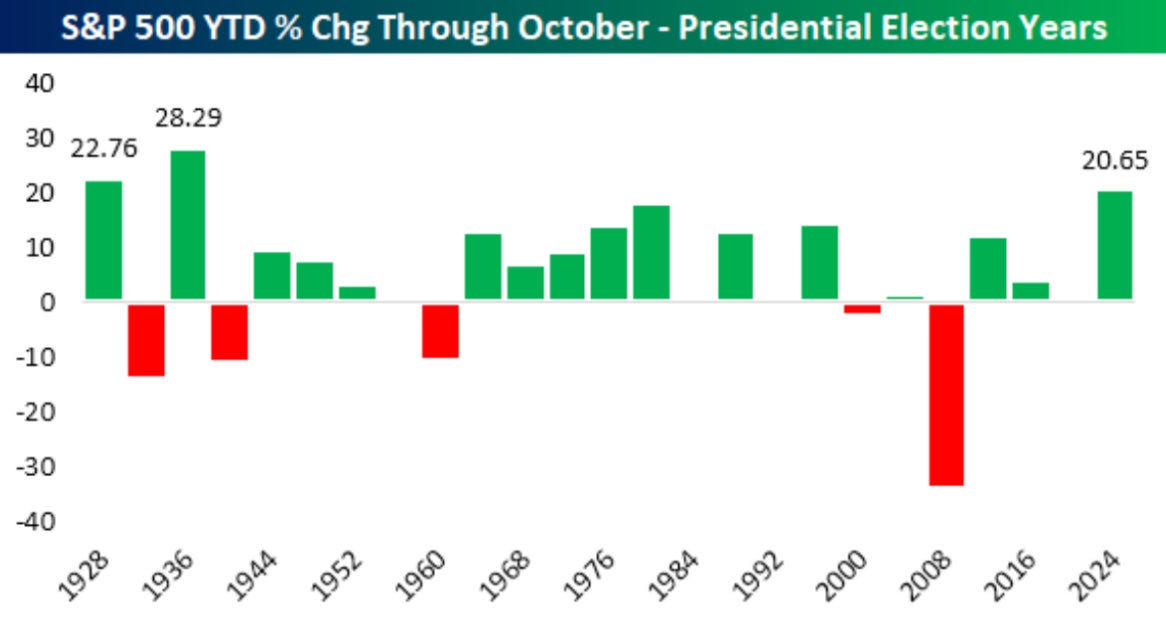

Though, this election year has arguably been unusual in that year-to-date returns have been well above average. Through Friday, the S&P 500 is up a little over 20%.

“[These gains] would join 2021 (+22.61%), 2019 (+21.17%), and 2013 (+23.16%) as the only years in the 2000s with gains of over 20% up through this point of the year,” Bespoke Investment Group observed on Thursday. “Only looking at election years, however, this year's gain is the largest YTD rally in the S&P 500 since 1936!”

This year is on track to be the best election year since 1936. (Source: @BespokeInvest)

“With equities having already posted huge returns this year, it raises the question of how performance looks for the rest of the year,” Bespoke added. “With only two prior examples of the S&P 500 rallying 20% YTD headed into a presidential election, it isn't a big sample size so not too much weight should be put on it, but returns in November and from October through year's end have been mixed. Both times saw gains in November while the index was higher for the rest of the year in 1928 and slightly lower in 1936. The only other election year when the S&P 500 was even up 15% YTD through the end of October (1980), November experienced a gain of 10.24% but the rest of the year's gain was just 6.5%.”

Perhaps the market has gotten a little ahead of itself. Perhaps not. We’ll only know what the rest of the year looks like until it’s behind us.

Will We Know Who Won The Election Next Week?

Election Day is Tuesday. But experts warn we might not get final results by the end of the day.

“With polls indicating another very tight race in 2024, many of the same factors that led to a delayed call in 2020 could be at play again,” Goldman Sachs’ Michael Cahill said on Tuesday.

Upgrade to paid

But that doesn’t mean the market won’t have a better sense of what the next four years could look like.

“While we cannot rule out the possibility of a very tight result and prolonged period of uncertainty, most likely the market will be able to gauge the likely presidential winner on election night or shortly thereafter, even if there are a few ‘head fakes’ in the first few hours and media sources take longer to make their call — just like last time,” Cahill said.

Zooming Out

You don’t have to look very far back in history to see a president you didn’t vote for or wouldn’t have voted for occupy the Oval Office. And odds are, the stock market performed pretty well during his term.

To be clear, of course it matters who the president of the United States is: It has an immediate impact on sentiment, it could have short-term and long-term social implications, and it may even move the needle on the potential for economic growth.

But from a long-term investor’s perspective, the president has an arguably marginal impact on the already existing forces driving the markets.

In the near-term, we should always brace for market volatility. But getting past this election uncertainty — regardless of who wins — could prove to be a tailwind for markets.

“Big picture, the reduction in uncertainty is almost always positive for asset prices, and we’re at that moment of peak uncertainty,” Ken Griffin, the billionaire founder of Citadel, said on Tuesday. “Post election, we'll generally see a risk-on environment as people come to adopt a new regime, whether it's a Harris regime or a Trump regime. This uncertainty will be behind us.”