A technology stock former Speaker of the House Nancy Pelosi (D-Calif.) disclosed owning back in February had a big rally this week with Palo Alto Networks (NASDAQ:PANW) beating fourth-quarter estimates.

What Happened: Palo Alto Networks reported fourth-quarter revenue and earnings per share that both beat estimates from analysts.

The company has beat estimates for revenue and earnings per share in several consecutive quarters, showing strength in the company's business segments. Palo Alto Networks also introduced fiscal year 2025 guidance that came in ahead of what analysts were forecasting.

Analysts raised price targets after the earnings report and shares rallied.

Earlier this year, Pelosi disclosed buying call options of Palo Alto Networks, with 50 call options bought on Feb. 12 and 50 call options bought on Feb. 21. Both trades were disclosed on Feb. 23.

The call options have a strike price of $200 and expiration date of Jan. 17, 2025.

Shares of Palo Alto Networks traded between $367.53 and $376.30 on Feb. 12 and between $260.09 and $275.98 on Feb. 21. The second transaction happened the day after Palo Alto Networks reported financial results and came as shares fell post earnings.

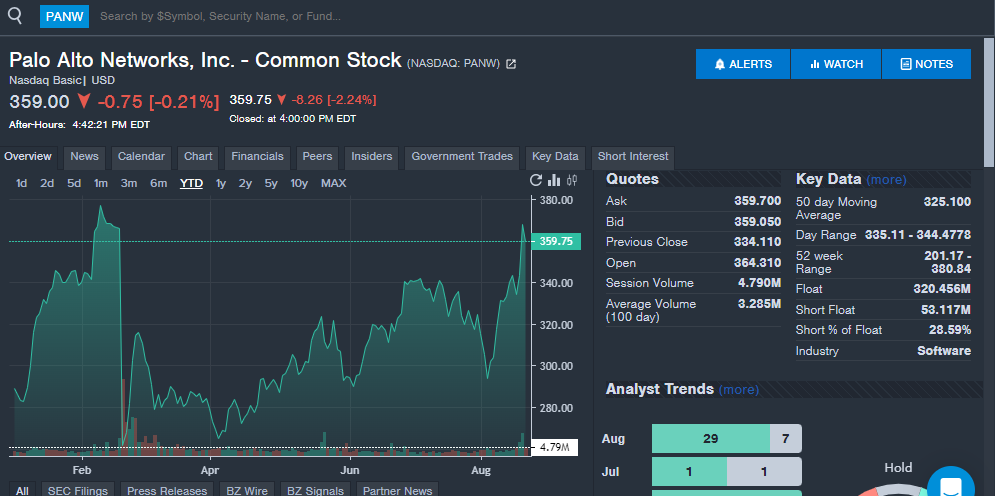

A look at the Benzinga Pro chart below shows Pelosi's Feb. 21 purchase was well-timed on a dip.

With Palo Alto Networks shares trading at $359.75 at the time of writing, Pelosi is now nearly even on her first trade made on Feb. 12 with the stock down 4.4% to 2.1% from the day of purchase depending on the purchase price.

Palo Alto Networks shares are up 30.4% to 38.4% from Pelosi's second purchase price.

The Congresswoman is now up significantly in around six months on the trade made by her husband Paul Pelosi.

Did You Know?

- Congress Is Making Huge Investments. Get Tips On What They Bought And Sold Ahead Of The 2024 Election With Our Easy-to-Use Tool

Why It's Important: Pelosi continues to be one of the most followed Congress members when it comes to disclosed stock and options trading activity.

The Pelosis have made over $1 million on their recent purchases of Nvidia stock and continue to disclose large purchases of technology stocks.

Following Pelosi’s trading activity can turn into profits for investors as well. Investors can follow her on the Benzinga Government Trades page.

Investors who bought shares of Palo Alto Networks on Feb. 23, when Pelosi's trade was disclosed, would be up 26.5% to 32.4% based on the $359.75 price at the time of writing and an intraday range of $271.62 to $284.32 for Palo Alto Networks shares on Feb. 23.

PANW Price Action: Palo Alto Networks shares were down 2.24% to $359.75 on Wednesday, erasing a portion of Tuesday's rallying stock price. The stock is up 23.4% year-to-date in 2024.

Check This Out:

- Lawmakers Made Huge Investments This Year. Get Tips On What They Bought And Sold Ahead Of The 2024 Election With Our Easy-to-Use Tool

Photo: Shutterstock